Interest Rate Expectations for 2025 - What You Need To Know...

The Fed Will Likely Drop Interest Rates in 2025... Mortgage Rates are Primed to Follow!

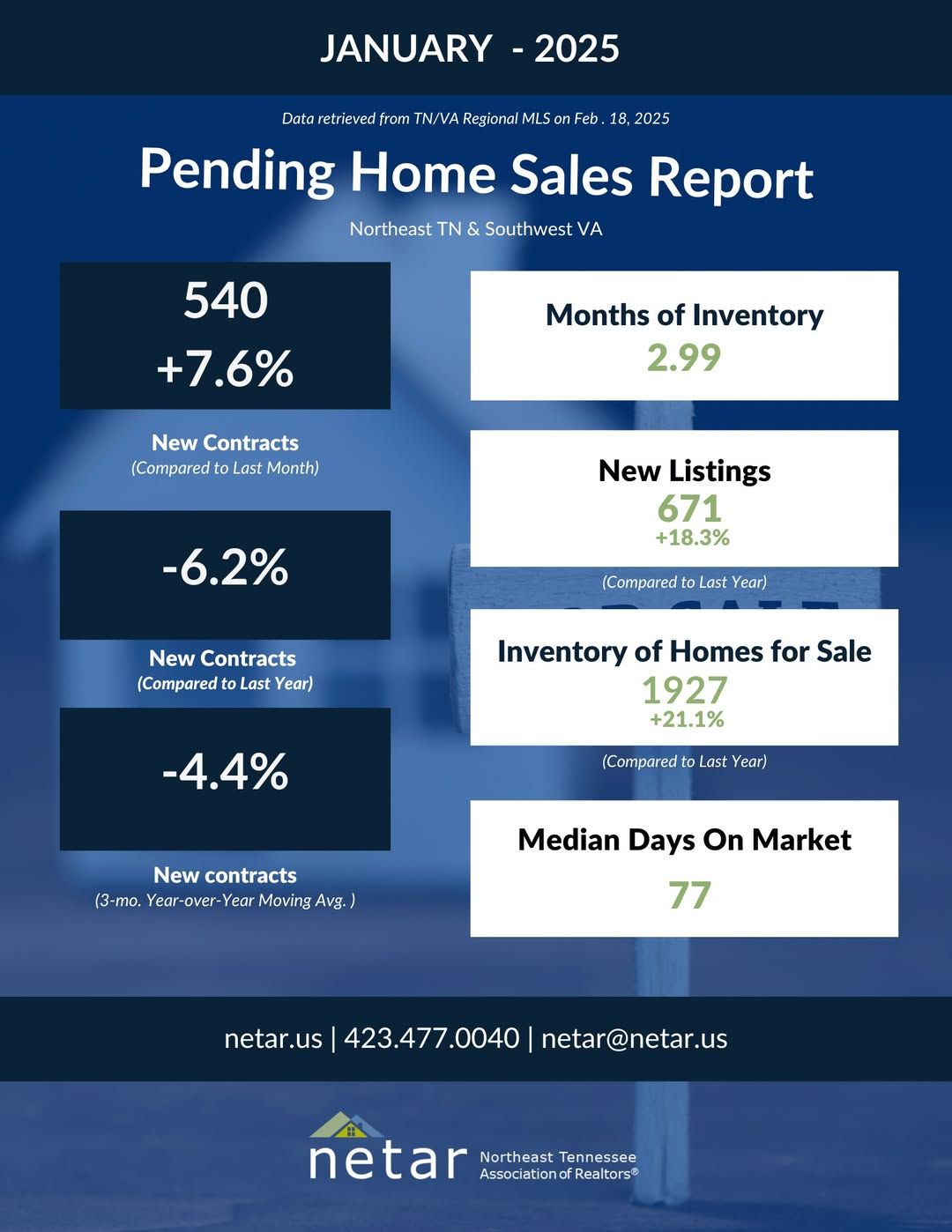

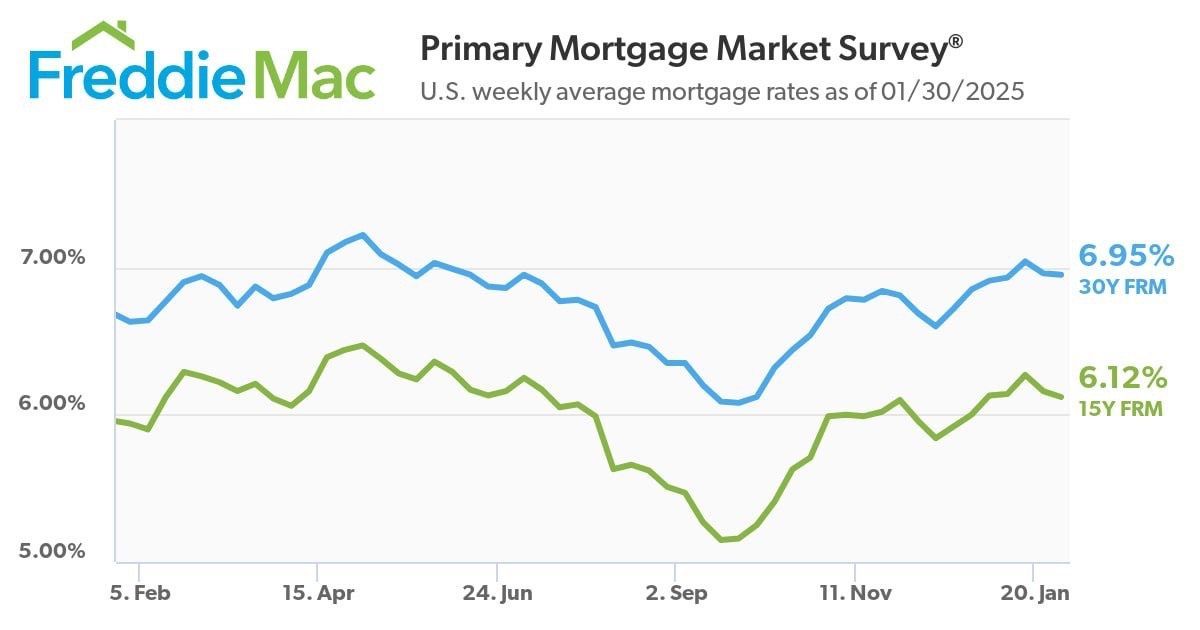

Despite the Federal Reserve's reductions in short-term interest rates, mortgage rates have remained largely unchanged. One factor contributing to this stability is the persistent consumer price inflation, which has shown signs of slight acceleration over the past two months and previous years. When lending money for the long-term, lenders must account for the potential loss of purchasing power in the future. Those potential losses to long-term lenders are now being realized in the form of higher interest rates on mortgages given the long-term nature of those loans.

Further cuts to the Federal Interest Rate are anticipated in 2025 as consumer prices are expected to stabilize significantly. Although multifamily house construction project starts have declined this year, the completion of new apartments continues robustly, stemming from last year's elevated apartment construction starts. This increased supply should help moderate rental prices, and as a result, the disparity between mortgage rates and other market rates is likely to narrow. If so, this will lead to a gradual decrease in mortgage rates.

With mortgage rates surpassing 6% for more than two years, consumers are adjusting to this new norm, especially in light of the 50-year average of 7.7%. The dynamics of jobs and inventory will play a crucial role in driving home sales as well. If you've been holding out for lower mortgage rates, OR if you're looking to refinance your mortgage as interest rates drop... 2025 could be your year!

Stay tuned in to the Market Pulse Blog here for updates on interest rates, and East Tennessee Real Estate Market Conditions. We'll help you find the perfect time to buy in 2025! Collins & Co. Realtors and Auctioneers is committed to guiding clients through every step of the real estate buying and selling process while also offering comprehensive property auction services. We'll help you achieve your goals, and we can even connect you with our reputable colleagues in the mortgage industry to ensure you get the best rates possible! Contact us to learn more. Let's land your dream home in 2025!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465

MLS #364 - Firm #265789 - P.A.L. #4465

The Tri-Cities' premier Real Estate Firm & Auction Management Company. Serving the Appalachian Highlands Region of East Tennessee since 1990.

LOCATION

112 Armed Forces Drive

Elizabethton, TN 37643

All Rights Reserved | Collins & Co. Realtors and Auctioneers

CONTACT US

Real Estate Office:

Auction Office:

Real Estate Office:

Auction Office:

Site Powered by