A "Rosy" Market for Home Buyers in 2025

REALTOR MAGAZINE cites top economists at NAR’s Real Estate Forecast Summit filling us all in on expectations for home buyers in the 2025 real estate market!

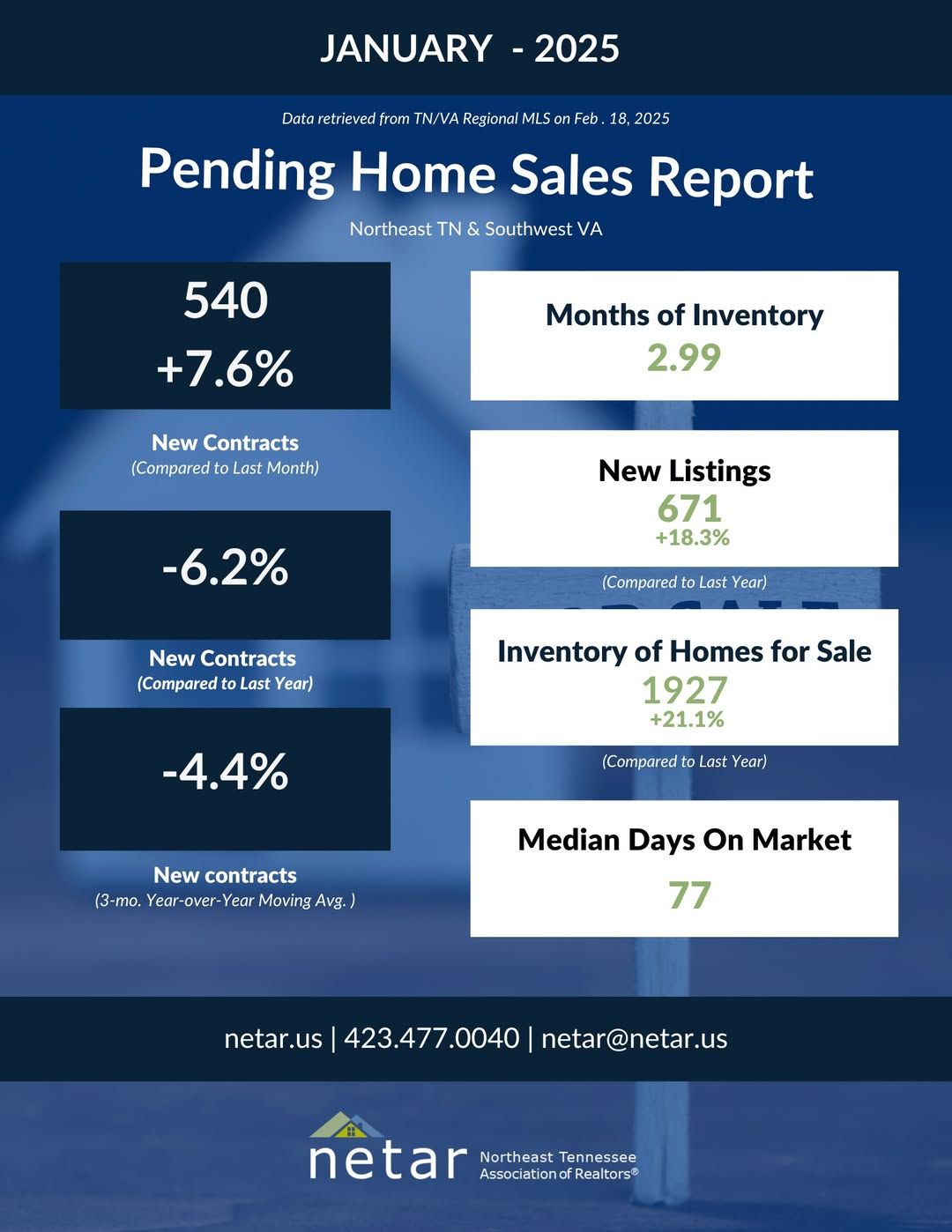

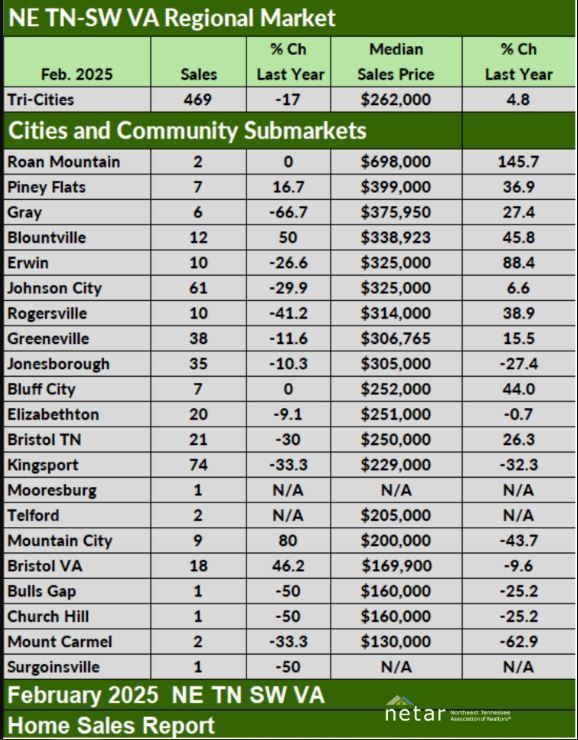

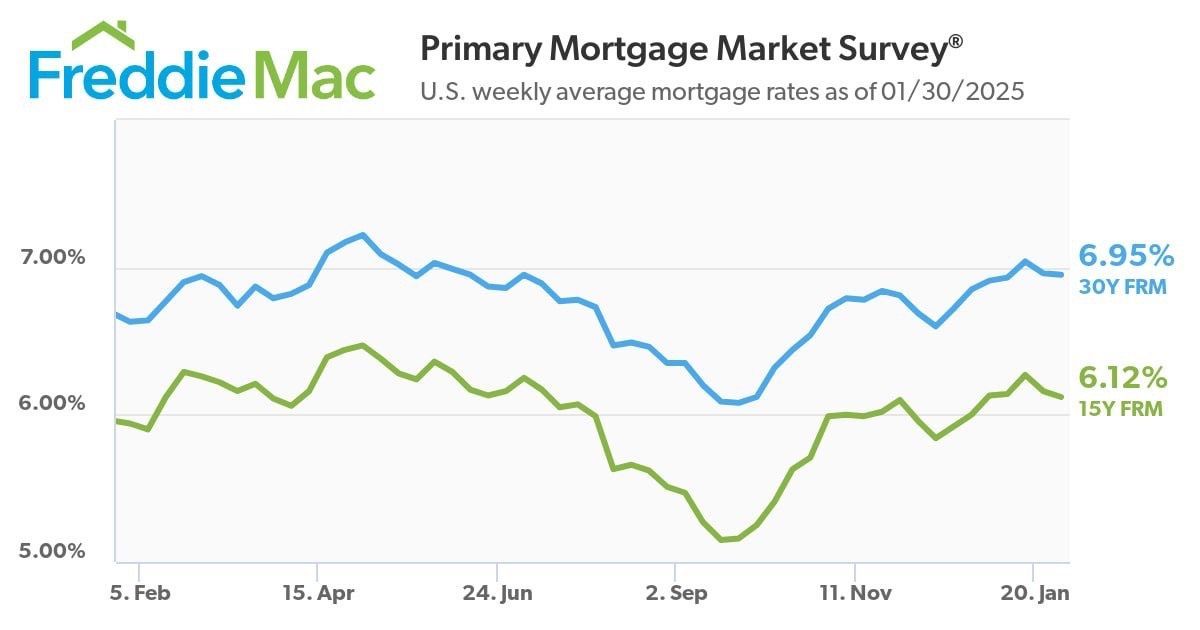

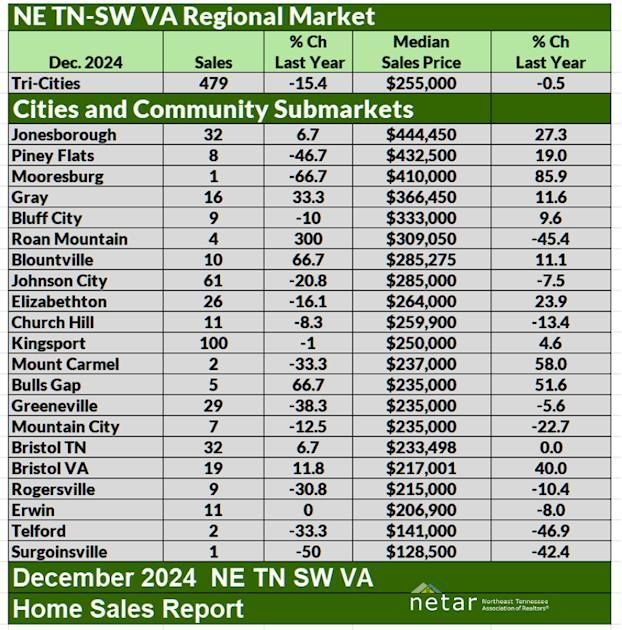

According to a recent report by Melissa Dittmann Tracey in REALTOR® Magazine, housing economists anticipate that 2025 could bring more opportunities for homebuyers, signaling a possible rebound in the housing market after two years of sluggish sales. During the National Association of REALTORS® (NAR) Real Estate Forecast Summit, experts discussed NAR’s 2025 housing outlook, which forecasts stronger home sales (following a 15-year low this summer), moderate increases in home prices, and more homes for sale—both new and existing. Mortgage rates are also expected to stabilize, further helping those looking at buying a home in the Tri-Cities, TN area.

NAR’s chief economist, Lawrence Yun, stated, “Home buyers will have more success next year,” noting that challenges related to affordability are easing. This, he explained, is due to factors like an increase in inventory, stable mortgage rates, and ongoing job and income growth, which will help more Americans achieve homeownership. NAR research suggests that if mortgage rates fall to around 6% in 2025, approximately 6.2 million more potential buyers could enter the market compared to when rates were near 7%.

Early signs of market recovery in the real estate and home buyers market in Tri-Cities, TN and beyond in 2025 are already evident, with home sales picking up this fall as mortgage rates slightly decreased from previous multi-decade highs above 7% to the mid-to-upper 6% range.

Michael Frantantoni, chief economist at the Mortgage Bankers Association, expressed optimism for the spring of 2025, emphasizing the alignment of various factors, especially the expected increase in housing inventory.

Key Housing Market Projections for 2025 and Beyond:

- Existing-Home Sales: +7% to 12% (2025), +10% to 15% (2026)

- New Home Sales: +11% (2025), +8% (2026)

- Median Home Price: +2% (2025, $410,700), +2% (2026, $420,000)

- Mortgage Rates: Near 6% (2025 and 2026)

- Job Gains: Near 2 million annually (2025 and 2026)

Housing inventory is expected to continue its upward trend, with listings increasing by 20% annually in October. Experts predict this rise in listings will continue through 2025 as more homeowners—who had been hesitant to sell—become motivated by stable mortgage rates and improving market conditions. Danielle Hale, chief economist at realtor.com®, expressed optimism about the growing inventory, which she believes will benefit both buyers and sellers.

This increase in inventory is expected to be driven partly by new home construction, which NAR forecasts will return to the historical average of 1.5 million units annually. Robert Dietz, chief economist at the National Association of Home Builders, highlighted that most of the new single-family home construction is occurring in the South, with builders focusing on the outer suburbs and exurbs, a trend that began during the pandemic.

Mortgage rates are projected to hover around 6% in 2025 and 2026, marking a shift from the ultra-low rates experienced during the pandemic. As a result, prospective buyers may have to adjust expectations, accepting a "new normal" in the mortgage market. This change is expected to reduce the "lock-in effect"—where homeowners stay in their current homes to retain lower mortgage rates—allowing more people to enter the housing market and benefiting those looking at buying a home in the Tri-Cities, TN area.

Despite rising home prices, which are forecast to increase by 2% in 2025, the pace of growth is expected to slow. This, along with more inventory and greater affordability, could help more people buying a home in the Tri-Cities, TN area move forward in the new year. However, first-time buyers may still face challenges in a market where prices remain high.

For more details, you can read the full article from REALTOR® Magazine here.

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465

MLS #364 - Firm #265789 - P.A.L. #4465

The Tri-Cities' premier Real Estate Firm & Auction Management Company. Serving the Appalachian Highlands Region of East Tennessee since 1990.

LOCATION

112 Armed Forces Drive

Elizabethton, TN 37643

All Rights Reserved | Collins & Co. Realtors and Auctioneers

CONTACT US

Real Estate Office:

Auction Office:

Real Estate Office:

Auction Office:

Site Powered by