How New Tariffs Could Affect the Housing Market: A Balanced Perspective

With the implementation of new tariffs making headlines, many homeowners and prospective buyers are wondering how these policies might impact the housing market. While conventional wisdom suggests tariffs on building materials would simply drive up costs and slow down the market, the reality is more nuanced. Let's explore the complex relationship between tariffs and housing.

The Two-Sided Impact of Tariffs

Tariffs create a balancing act of opposing forces in the housing market:

Potential Negative Effects:

- Higher Construction Costs: Tariffs on imported materials like lumber, steel, and aluminum directly increase the cost of building new homes and renovating existing ones.

- Supply Chain Disruptions: As manufacturers adjust to new import costs, we may see delays and shortages in certain building materials.

- Reduced New Construction: Developers may scale back projects when facing higher material costs, potentially worsening housing shortages in high-demand areas.

- Economic Uncertainty: Broader economic concerns related to tariffs could make some buyers hesitant to make major purchasing decisions.

Potential Positive Effects:

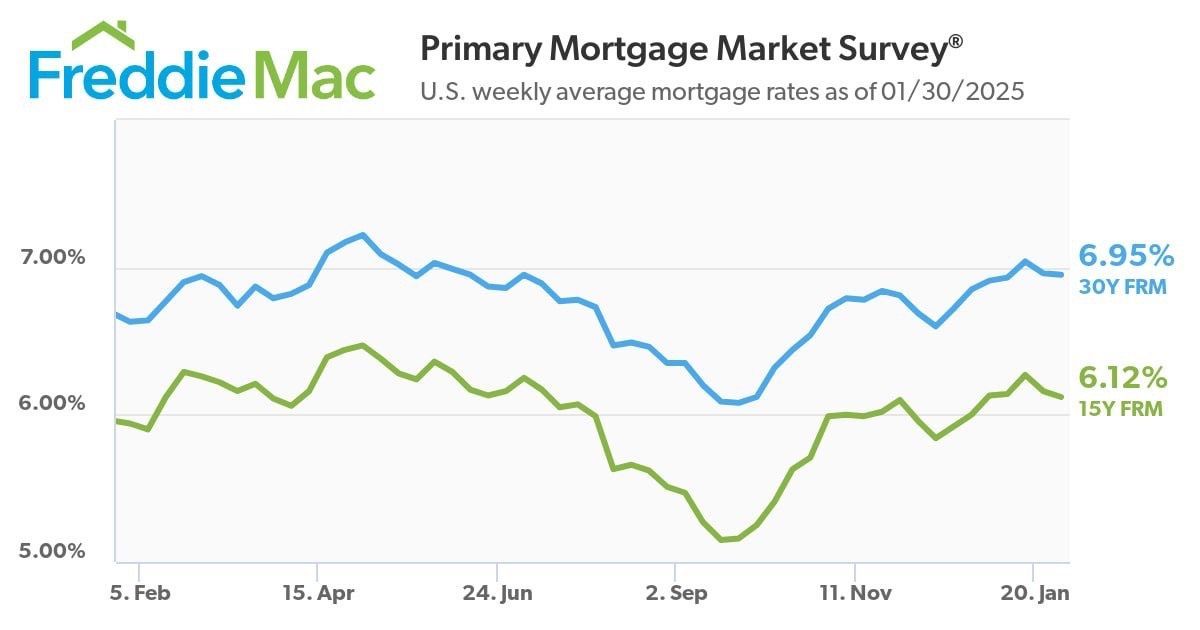

- Lower Mortgage Rates: As economists have noted, tariffs can slow economic growth, which often prompts the Federal Reserve to lower interest rates. This could translate to more favorable mortgage rates for buyers.

- Increased Competitiveness of Existing Homes: As new home prices rise due to higher building costs, existing homes may become relatively more attractive to buyers.

- Regional Manufacturing Boosts: Some local building material manufacturers might see increased demand, potentially creating jobs in certain regions.

Who Stands to Gain or Lose?

Different segments of the housing market will likely experience varying impacts:

- First-time homebuyers may benefit from lower interest rates but face higher prices for entry-level new construction.

- Luxury homebuyers might see the most significant price increases, as high-end homes typically use more imported materials.

- Homeowners planning renovations could face higher costs and potentially delayed projects.

- Current homeowners with no plans to sell might benefit from increased property values if housing supply tightens further.

The Regional Factor

The impact will likely vary significantly by location:

- Areas with heavy reliance on new construction to meet housing demand could see more pronounced effects.

- Markets already facing severe affordability challenges might experience additional pressure.

- Regions with strong local building material production might be partially insulated from certain cost increases.

Looking Ahead

For those navigating the housing market during this period of tariff implementation, flexibility and awareness will be key. Prospective buyers should pay close attention to both housing prices and mortgage rate trends, as the balance between these factors will determine overall affordability.

While economic policies like tariffs create ripple effects throughout various sectors, the housing market's inherent regional nature and the counterbalancing forces at play suggest that we'll see varied, rather than uniform, impacts across the country.

What's certain is that the relationship between tariffs and housing is more complex than it might initially appear. By understanding these nuances, market participants can better position themselves for whatever changes may come.

SHARE THIS POST!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465